Finally, a solution that covers it all -

from tax law training, to real-life tax prep practice, to expert tax pro tips and beyond.

Introducing........

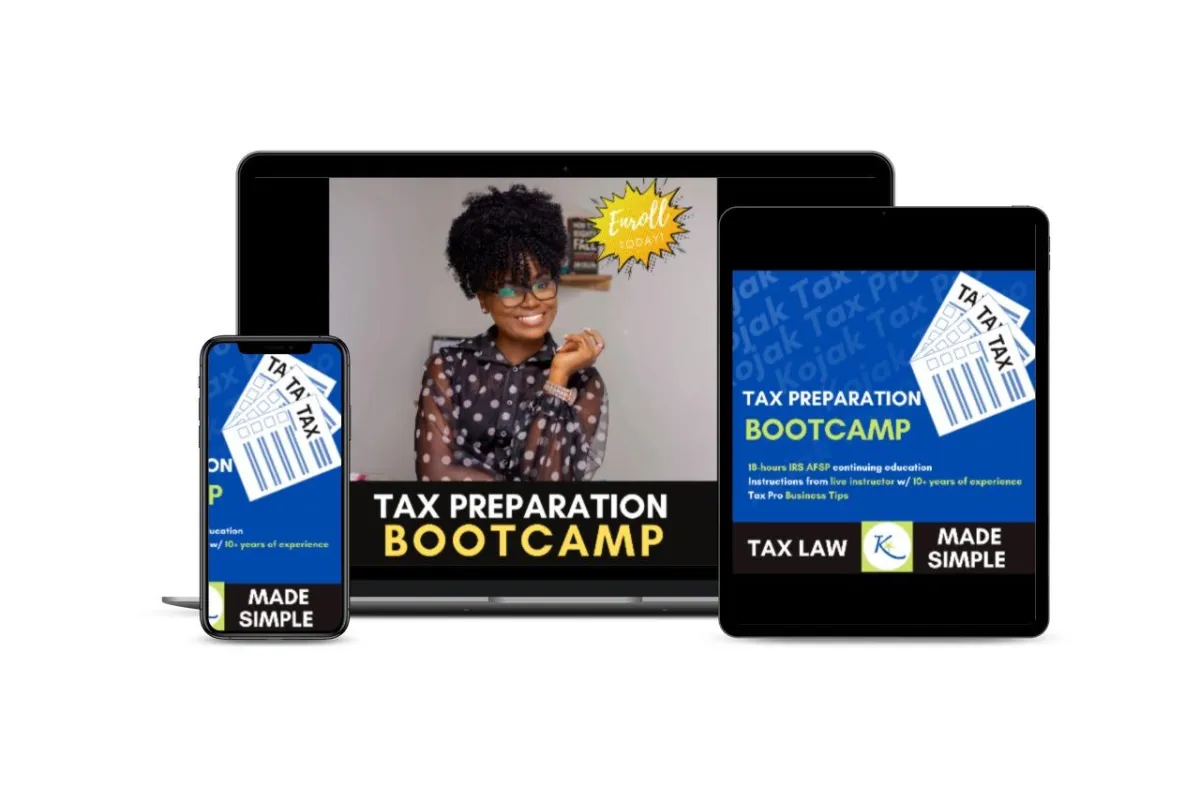

Kojak Tax Pro

Tax Preparation Boot Camp

September 6-8, 2022, 6:00 - 9:00PM CST

Inside the Kojak Tax Pro Boot Camp, you'll get everything you need to professionally prepare income tax returns with confidence so that you can improve customer satisfaction and avoid mistakes that lead to audit problems.

Join today - doors close soon!

- Here's some stuff

Tell me if this sounds like you....

You want to learn tax law in a friendly, supportive environment.

You are ready to fire your boss and learn something new.

You're tired of feeling like you'll never meet your goals.

You want to complete your continuing education credits.

You want to launch and build a profitable tax business.

Good news!

I help my clients with those same problems every single day.

And if you're like any of them, you've probably made some of the same mistakes.

Mistakes like....

Myth 1: You need to be a CPA or have an accounting degree to be a Tax Professional

REALITY:

Tax preparation is not accounting, it's law

Myth 2: Tax Preparation is for 'numbers' people

SPOILER ALERT:

It's actually a people business. Your clients trust you to take good care of their data and details.

Myth 3: You need to work for a tax franchise to quickly learn the tax business.

NO WAY! The Truth?

Tax preparation is a very affordable career option that can be learned with dedication in the comfort of your own home.

Imagine.....

There was a way to learn tax law basics quickly ...

There was a way to work with a supportive community to keep you on track to meet your goals....

You could wake up everyday with confidence to new client appointments

You could impact people by sharing your skills, your knowledge, and your gifts to create generational wealth...

F

All of that's possible inside

Kojak Tax Pro Boot Camp

Join Today for $149! Doors are closing soon.

About the 3-Day Boot Camp

Boot Camp Day 1: Basic Building Blocks

On Day 1, you’ll learn to identify those persons who must file an individual federal income tax return and determine the appropriate filing status. You will learn taxes from an experienced tax professional in an active and engaging virtual experience.

Day 1 gives you what you need to be a confident Tax Pro!

Boot Camp 2: Practice Makes Perfect

On Day 2, you will get to know the credit section of Form 1040 and the more common credits you might see in your tax practice. The Bootcamp will meet all the CE requirements of the IRS Non-Exempt Preparer Annual Filing Season Program (AFSP).

Boot Camp 3: Self-Employed Return Made Simple

On Day 3, you will master the Schedule C self-employment income to maximize the tax deductions for your clients.

As a bonus, we infuse tax preparation practice into the Bootcamp so that each student can both learn and implement using a complimentary copy of our professional tax software.

Hi I'm Paula

I'm a four-time entrepreneur and 13-year tax strategist who works with tax preparers to help them create and launch a profitable, tax practices so that they can starting scaling their income with less frustration and more support.tr

My favorite things to nerd out about are home design, gluten-free recipes, adult coloring books, and the Discovery Channel.

My greatest joy is a day full of Easter egg hunts —but my second greatest joy is helping tax professionals embrace and share their gifts with the world so they can scale both their impact and income.